california mileage tax bill

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Californias Proposed Mileage Tax California has announced its intention to overhaul its gas tax system.

Examining Mileage Based User Fees As A Replacement For Gas Taxes Reason Foundation

Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results.

. Between 2008 and 2014 at least 19 states considered 55 measures related to mileage-based fees according to the National Conference of State Legislatures. SACRAMENTO - Senator Scott Wiener D-San Francisco introduced Senate Bill 339 the Gas Tax Alternative Pilot. Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes.

Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. WASHINGTON The tens of millions of Americans living near Superfund sites could soon get some welcome news. DeMaio is leading the statewide fight through his Reform California campaign committee to block the Mileage Tax from being imposed - and hes targeting most of his efforts to block the first Mileage Tax pilot project in San Diego county.

This means that they levy a tax on every gallon of fuel sold. When business raise prices on goods to cover the cost of a mileage tax the state collects more sales tax revenue. This pilot program which allows California to explore charging based on vehicle miles traveled VMT instead of relying on gas taxes is a critical strategy as the state transitions away from fossil fuels.

The sweeping health care and climate change bill the House is expected to pass. Please visit our State of Emergency Tax Relief page for additional information. The law though does not reveal how the state will collect the necessary information to track mileage.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. The bill would require the Transportation Agency to consult with appropriate state agencies to implement the pilot program and to design a process for collecting road charge revenue from vehicles. Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay Area lawmaker. Instead of paying the states gas tax which.

The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes. For 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0585 per mile10They both increased the reimbursement rate 25 cents from 2021. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

California state and local Democratic politicians are trying to implement a Mileage Tax on all drivers by 2025. Businesses impacted by recent California fires may qualify for extensions tax relief and more. Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee.

California recently authorized its own mileage tax pilot project. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax. For questions about filing extensions tax relief and more.

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Could be revenue generating for service companies. The Mileage Tax would be the death blow to many families pricing them out of our state said DeMaio.

October 1 2021 Keith Goble California Gov. California Expands Road Mileage Tax Pilot Program. Gas taxes fund Californias roads highway system.

For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile10They both increased the reimbursement rate 4 cents from the first half of 2022. Traditionally states have been levying a gas tax. Other states will follow.

At President Joe Bidens direction the federal government is currently exploring a Mileage Tax pilot program. Replacing Californias gas tax. But Oregon is leading the way.

The money so collected is used for the repair and maintenance of roads and highways in the state. Im authoring a bill SB339 to evaluate a road charge based on vehicle miles traveled to. Vermont and Washington enacted bills to study per-mile fees in 2012.

The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan. Workers who use their personal vehicles for business purposes will have to track their mileage. Service vehicles will charge based on mileage from their office to your location.

Please contact the local office nearest you. The bill would require that participants in the program be charged a mileage-based fee as specified and receive a credit or a refund for fuel taxes or electric vehicle fees as specified. Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a mileage-based user fee - is a fair and sustainable way to fund road maintenance preservation and improvements for all Californians.

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

What Would A Vehicle Mileage Tax Mean For Ride Share

Opinion San Diego Drivers Shouldn T Be Taxed On The Miles They Drive Times Of San Diego

A Primer On Vehicle Miles Traveled Taxation Concepts California Globe

What Are The Mileage Deduction Rules H R Block

Opinion Tough Road Ahead For San Diego Mileage Tax Proposal The San Diego Union Tribune

County City Leaders Push Back Against Proposed Mileage Tax

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Everything You Need To Know About Vehicle Mileage Tax Metromile

New Vehicles To Average 40 Mpg By 2026 Undoing Trump Change Los Angeles Times

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

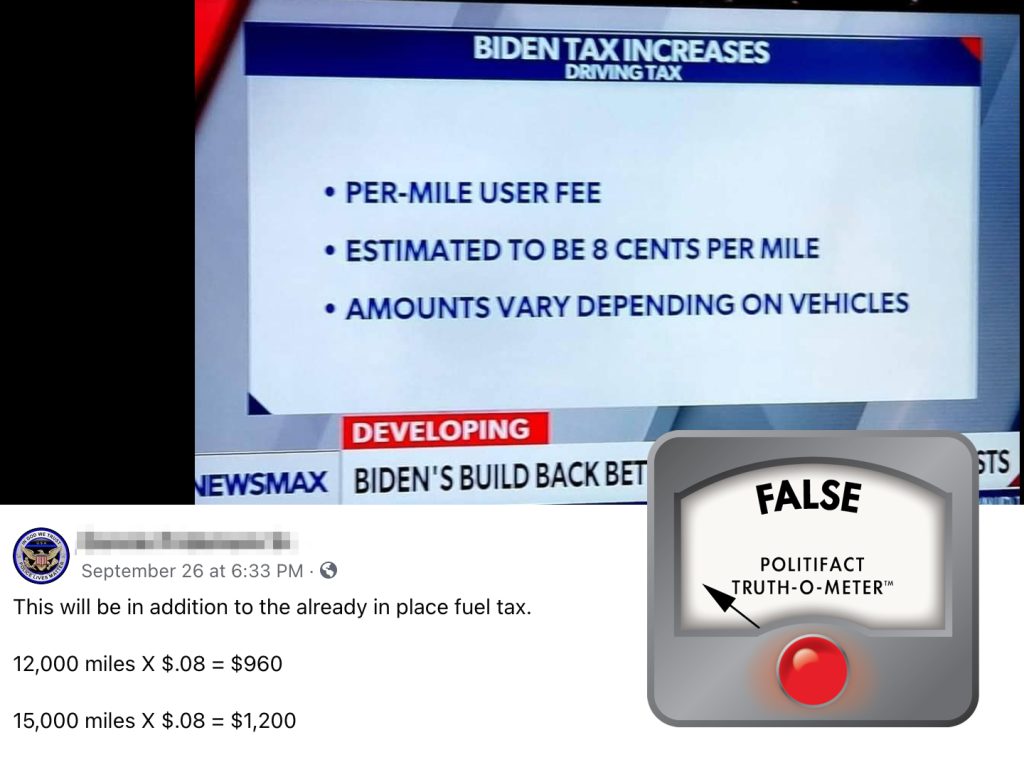

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Irs Mileage Reimbursement 2022 Everything You Need To Know About